FINANCE

The New Portfolio Theory: Diversifying Your Cloud Commitments Like an Investment Portfolio

In finance, Modern Portfolio Theory (MPT) teaches that diversification reduces risk without necessarily reducing returns. Cloud financial management is no different. The mix of Reserved Instances (RIs), Savings Plans (SPs), and Enterprise Commitments (like PPAs) a company holds is effectively its cloud commitment portfolio, and balancing that mix can make or break your cost efficiency.

Cloud commitments are investments. They trade liquidity for predictability. They balance volatility with return. And like any portfolio, their performance depends on allocation, timing, and the risk appetite of the investor, in this case, your FinOps and procurement teams.

Translating Portfolio Theory into FinOps Practice

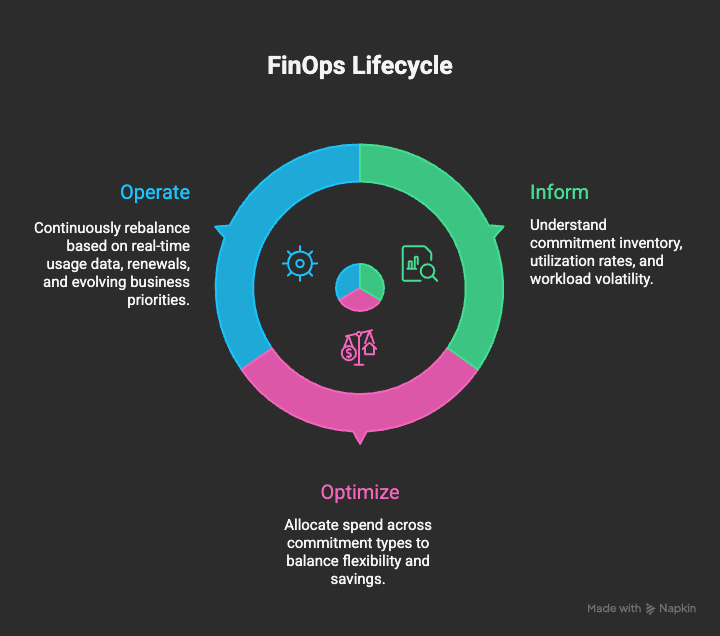

FinOps is built on three core principles: Inform, Optimize, and Operate. Each stage can directly map to portfolio management:

This is the new portfolio theory for FinOps. It’s not just about chasing the biggest discount, it’s about designing a commitment strategy that behaves like a resilient investment fund.

RIs: High Yield, Low Liquidity

Reserved Instances offer the highest potential discount (up to 72% off on-demand pricing, according to AWS public pricing data), but they come with lock-in risk. Think of them as high-yield bonds, strong returns if held to maturity, but inflexible when your workloads shift.

When teams over-index on RIs, they expose themselves to utilization risk. Idle RIs are like idle capital, they erode your Effective Savings Rate (ESR) and inflate amortized waste. The FinOps principle of accountability comes into play here. Engineering and finance must jointly own these decisions, ensuring RIs are aligned to stable, predictable workloads.

Savings Plans: The Flexible Middle

Savings Plans introduced liquidity into the commitment market. They provide up to 66% off on-demand pricing, depending on type (Compute vs EC2 Instance). SPs trade some yield for flexibility, automatically applying discounts across instance families and regions.

In investment terms SPs behave like index funds, they’re broadly diversified, easier to manage, and resilient to short-term volatility. They fit well for organizations still maturing their FinOps practice or modernizing workloads that fluctuate seasonally or through AI experimentation.

PPAs: The Long-Term Bond

Enterprise Commitments (ECs) or Private Pricing Agreements (PPAs, formerly EDPs—including Azure MACCs and Google Commitments) function like long-term treasury bonds. They require high-volume, multi-year commitments and deliver predictable, contractually guaranteed discounts that often range between 20% and 30%, depending on spend thresholds and deal structure.

An Enterprise Commitment portfolio is less about individual instances and more about commitment velocity—how fast a company burns down its pledged spend. This is where FinOps × Procurement collaboration becomes critical. Visibility into marketplace transactions, private offers, and partner incentives can make or break utilization timelines.

According to Gartner’s 2025 forecast, enterprise cloud spending is projected to reach $723.4 billion globally, up from $595.7 billion in 2023 (Gartner, Forecast: Public Cloud Services, Worldwide, 2023-2025). As PPAs expand, so does the need for precision in how commitments are modeled, monitored, and rebalanced.

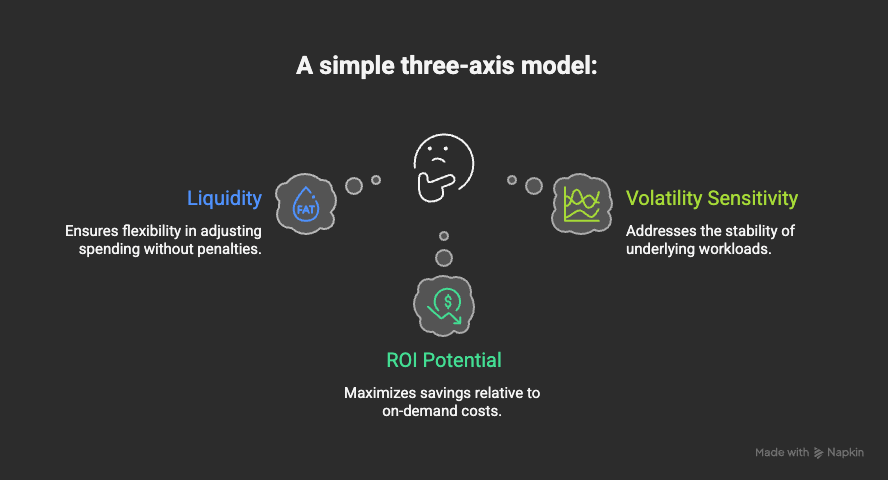

Visualizing the Cloud Commitment Portfolio

Plot RIs, SPs, and PPAs on this model, and you’ll get your commitment exposure map. Finance can then layer in amortization curves and depreciation modeling to see when certain commitments begin to lose value.

This portfolio view allows organizations to forecast cloud savings like financial analysts forecast investment performance. It turns commitment strategy into a quantifiable, communicable framework across finance, procurement, and engineering.

Actionable Strategies for a Balanced Cloud Portfolio

Match Commitment Type to Workload Predictability

Use RIs for steady-state compute.

Use SPs for dynamic, variable workloads.

Anchor with ECs for enterprise-wide scale and vendor alignment.

Diversify Across Services

Extend analysis beyond EC2. Include SageMaker, Fargate, and Databricks.

Apply portfolio logic to cross-service spend categories.

Amortize Dynamically

Move from fixed monthly amortization to usage-weighted amortization. This approach reflects real workload behavior and helps finance teams map cost to actual business value.

Rebalance Quarterly

Commitments should be re-evaluated every quarter alongside financial forecasting cycles. This keeps spend aligned with both engineering velocity and budget variance.

Build a FinOps Governance Board

Treat cloud commitment strategy like a financial fund—one that’s co-managed by FinOps, Finance, and Procurement. Decisions about renewals, rebalancing, and future commitments should be reviewed as part of an internal Investment Committee model.

Final Thought

Diversification is discipline. FinOps gives that discipline a home. When you treat your cloud commitments like a living portfolio—constantly informed, optimized, and operated you shift from reactive cost control to proactive financial strategy.

The new portfolio theory isn’t a metaphor, it’s the next evolution of FinOps maturity.

Tired of newsletters vanishing into Gmail’s promotion tab — or worse, being buried under ad spam?

Proton Mail keeps your subscriptions organized without tracking or filtering tricks. No hidden tabs. No data profiling. Just the content you signed up for, delivered where you can actually read it.

Built for privacy and clarity, Proton Mail is a better inbox for newsletter lovers and information seekers alike.

NEWS

The Burn-Down Bulletin: More Things to Know

How to Build a Balanced Cloud Commitment Portfolio (VMware)

VMware explores how to layer Reserved Instances and Savings Plans to create a risk-balanced commitment mix, helping FinOps teams align allocation decisions with workload predictability and financial goals.AWS Savings Plans vs. Reserved Instances: 5 Key Differences in 2025 (Finout)

Finout breaks down the trade-offs between liquidity and yield across RIs and SPs, explaining how organizations can balance coverage, flexibility, and risk in their cloud investment portfolios.Simplifying Your AWS Private Pricing Addendum (Ensono)

Ensono outlines how enterprises can approach Private Pricing Agreements (formerly EDPs) as long-term financial instruments, detailing negotiation tips, burn-down velocity tracking, and cross-functional governance models.AWS Policy Changes: Decentralizing RI and SP Management (Flexera)

Flexera analyzes AWS’s latest policy updates that decentralize commitment management, explaining how these changes improve liquidity and flexibility for multi-account enterprises and MSPs.Private Pricing Agreements as a Strategic Anchor for Cloud Portfolios (Crayon)

Crayon highlights how long-term PPAs can anchor enterprise commitment portfolios, providing predictable spend, procurement leverage, and financial stability in multi-cloud environments.

That’s all for this week. See you next Tuesday!