FINANCE & PROCUREMENT

Renewals With Receipts: Applying FinOps To Extend, Resize, Or Exit

Renewals are always happening. That is what makes them such an underrated FinOps playground. Every contract that comes up asks the same question:

Did we actually get the value we thought we would?

Most of the time, renewals get “rubber stamped.” The same terms, the same annual amount, the same assumptions as the original deal. It is fast, it is familiar, and it keeps the wheel turning.

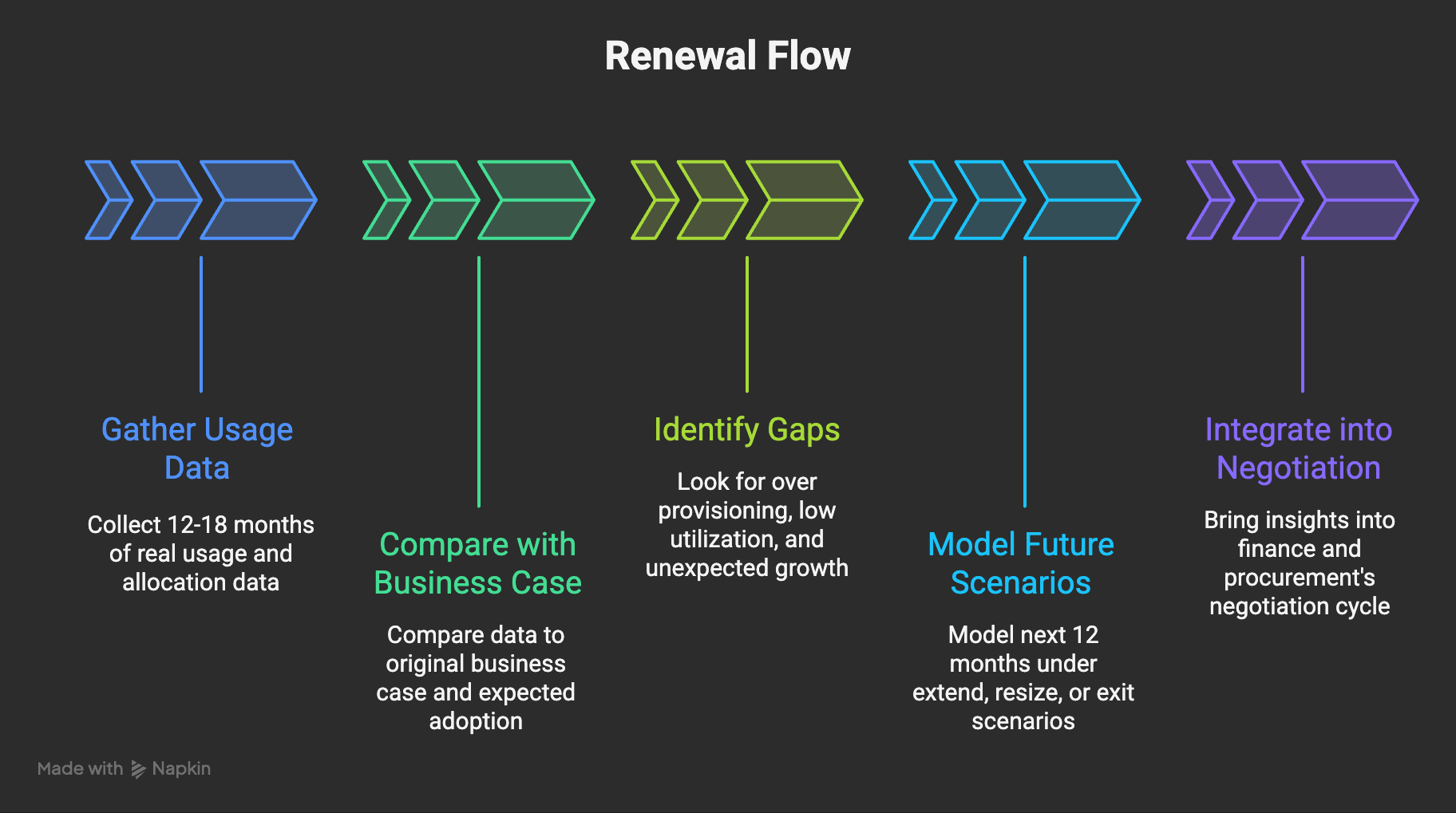

This issue explores a renewal review pattern I’ve been learning myself: pull 12 to 18 months of usage data, compare it to the original business case, and let the numbers tell the story before procurement ever contacts the vendor.

It is a simple pattern, but it changes the tone of the whole conversation.

The Renewal Review Pattern

One helpful way to think about renewals is to treat them like any other operational decision. Not “Should we renew?” but “Does our actual usage justify the renewal we think we need?”

Most teams I talk to do something like this:

Those conversations sit in isolation unless FinOps provides the connective tissue:

the actual usage, utilization, and unit cost story behind the last year of consumption.

A simple renewal review flow could look like:

Nothing complicated, just a bit more clarity that goes a long way.

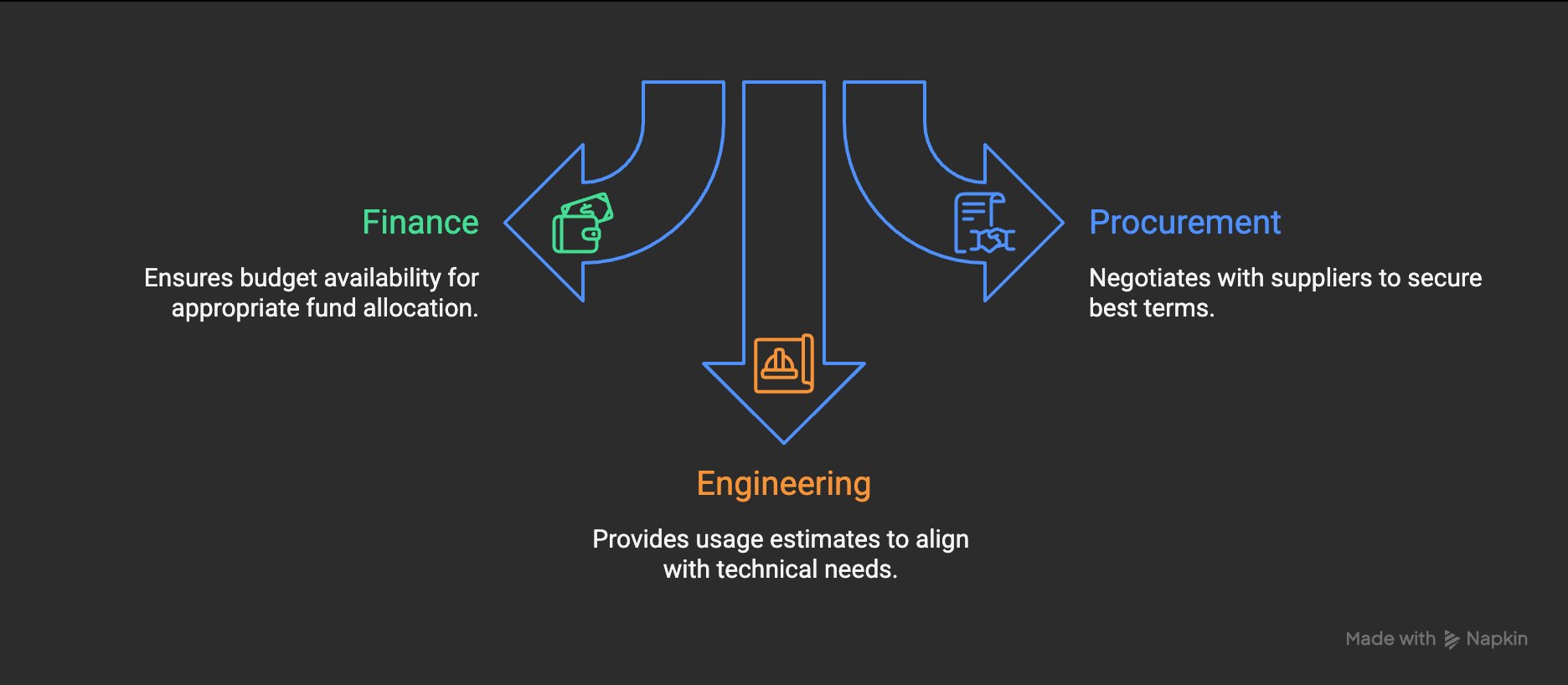

What Each Team Brings to the Table

One of the things I love about renewals is how cross functional they naturally are. Nobody owns the decision alone.

FinOps brings usage trends, utilization patterns, and unit economics. The story of what the business actually consumed and how that cost behaved.

Finance brings budget impact, amortization curves, cash flow, and margin considerations. They can translate renewal choices into business performance.

Procurement brings negotiation, vendor history, term options, discount structures, and renewal leverage. They shape how the deal actually changes.

When these three perspectives meet early, renewals stop being administrative and start becoming strategic.

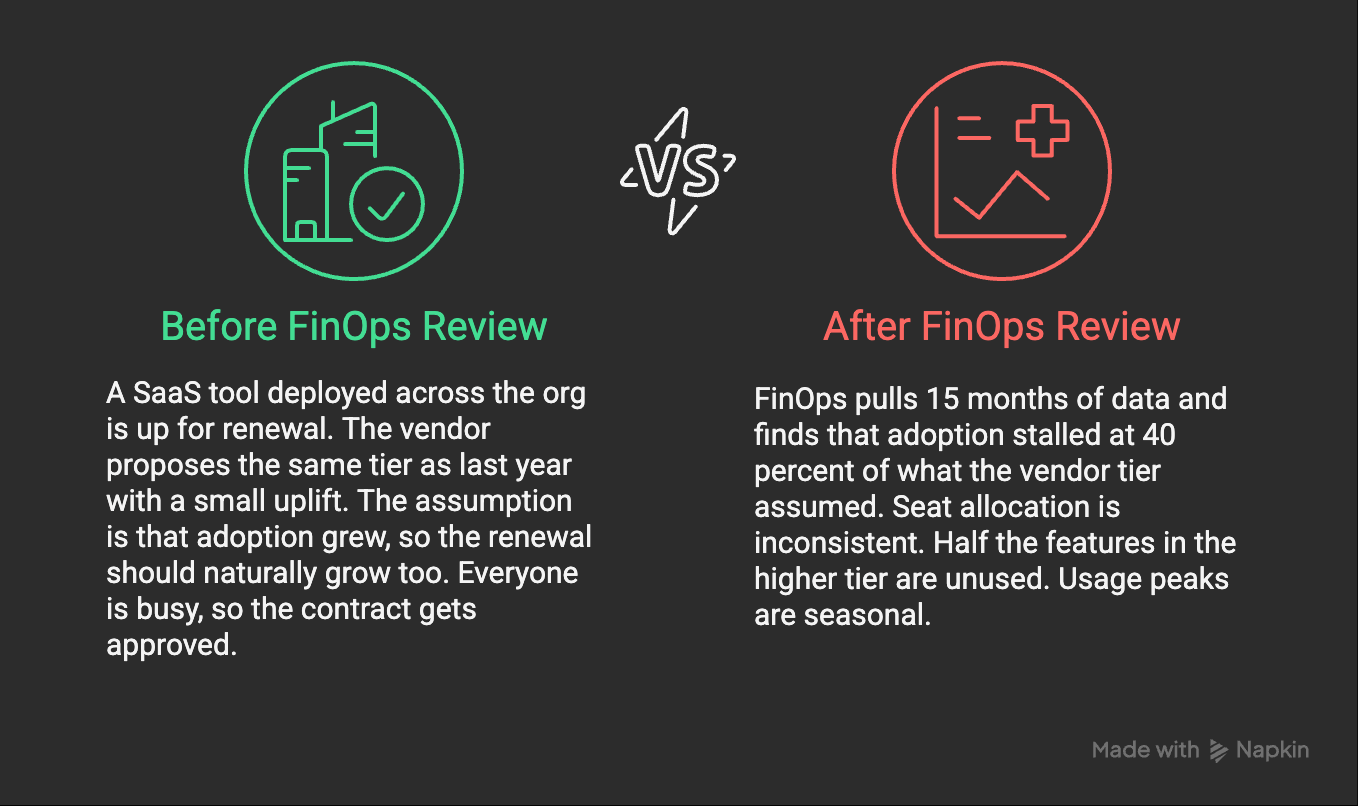

A Before and After Example

Here is a common pattern:

Suddenly the renewal conversation changes from “We need the same thing” to “We may be overpaying for something we barely use.” Finance sees the unused margin drag. Procurement enters negotiations with leverage they did not have before.

Engineering can plan for a right sized tier or even evaluate alternative tools.

Same renewal. Entirely different outcome. This is what I mean when I say renewals are a FinOps playground.

Why This Matters in a Cloud World

Cloud has trained us to think in continuous evaluation. Nothing is static anymore. SaaS, cloud services, AI platforms, data tools. They all behave like living infrastructure.

Renewals are one of the few predictable checkpoints we get every year to pause and ask: Are we consuming this the way we thought? Is the unit cost going up or down? Is the product embedded in our workflows or barely adopted? Does it still support the business case we pitched 12 months ago?

Some teams find that this reframes the negotiation entirely. Others use it to build a clearer relationship with finance. I am noticing that it also helps engineering stay connected to the cost side of the tools they depend on.

Renewals are a chance to turn “we think” into “we know.”

Check out the latest FinOps Weekly Podcast featuring… ME!↓

RESOURCES

The Burn-Down Bulletin: More Things to Know

5 Best Practices for Effective SaaS Renewal Management

Zylo walks through a practical SaaS renewal playbook: assigning app owners, centralizing contracts, tracking renewal calendars, and using spend visibility to avoid overpaying when contracts roll over.SaaS Renewal Best Practices: Using Data To Optimize Spend

Vertice focuses on the “renewals with receipts” idea directly, showing how to compare license allocation vs actual usage, benchmark pricing, and use that data to right size or renegotiate before you sign the next term.Contract Renewal Strategy: 5 Smart Tactics To Streamline Renewals

CloudEagle highlights how often contracts auto renew without scrutiny and offers tactics like proactive communication, renewal calendars, and data informed decision making so teams can extend, resize, or exit with intention.How To Address Public Cloud Commitments, Contract Burndown And Consumption

WWT zooms in on cloud provider commitments, explaining how to evaluate whether you are overcommitted, model burn down paths, and adjust your strategy before the next big renewal lands.4 Strategies For ‘Winning’ IT Vendor Negotiations

CIO Dive shares negotiation moves that pair well with FinOps data: capping renewal price increases, unpacking line item costs, and using detailed breakdowns to push for better terms instead of rubber stamping prior contracts.

That’s all for this week. See you next Tuesday!