FINANCE

Forecasting Elastic Spend: How Finance Rebuilds Cloud Budgets With FinOps

Cloud broke the idea that big costs should behave like rent. Your office lease will not spike because a product manager ran an experiment over the weekend. But your cloud bill can, and often does.

Finance is still expected to produce clean budgets, reliable forecasts, and confident plans. The challenge is that cloud spend is elastic and jumps around month to month, especially with AI workloads, new features, and rapid experimentation.

This issue breaks down how finance and FinOps teams can build realistic, flexible, and honest cloud forecasts without pretending the cloud is predictable.

The theme: you cannot make cloud predictable, but you can make it forecastable enough to run a real plan.

1. Before forecasting: get allocation and categories right

You cannot forecast what you cannot see.

Finance and FinOps need a strong starting point:

2. Move from annual plans to rolling cloud forecasts

Traditional budgeting locks a plan in place for 12 months. Cloud consumption doesn’t care about that timeline.

A more practical model is a rolling forecast, always looking 12–18 months ahead and updating it every month.

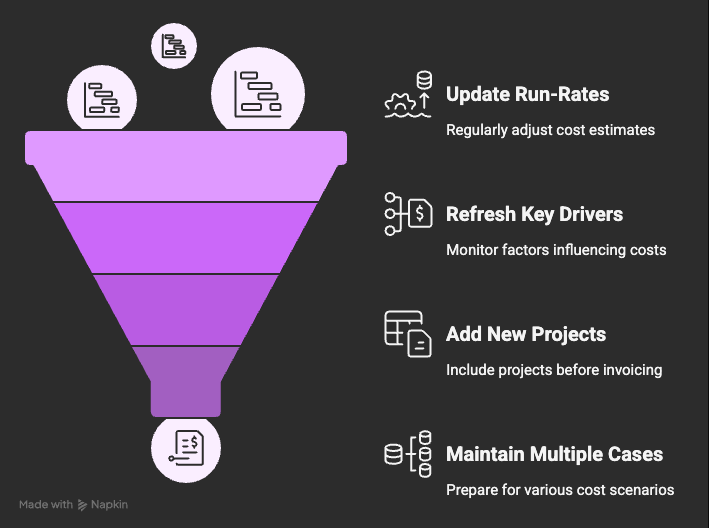

Rolling forecasting for cloud means:

You don’t need perfect math. You just need a model that responds to how your workloads actually behave.

Keep it simple with driver-based forecasting

For example:

Core compute = active users × average usage

AI workloads = number of inferences or training runs

Data = volume stored × retention × queries

The goal is directionally correct forecasts built on the same inputs the business already uses.

3. Bring engineering and product into the forecasting loop

One thing becomes clear the more you learn FinOps: cloud forecasts get better when more people understand how their work affects spend.

This isn’t about building a perfect cross-functional process. It’s simply recognizing that engineering and product usually know what’s coming next long before it shows up in a billing file. Even hearing things like:

“We’re testing a new feature next month.”

“We’re moving a workload to a new service.”

“We expect more traffic after the next release.”

FinOps naturally becomes the translator between product plans and financial expectations. You don’t need a new system. You just need that information earlier than the invoice.

4. Looking at variance without making it complicated

Cloud variance (the difference between what you expected to spend vs. what actually happened) can feel intimidating, but it doesn’t have to be a deep financial exercise.

A simple, approachable way to think about variance is:

Did usage change?

Did unit cost change?

Did something new happen?

This keeps the focus on understanding what happened, not blaming anyone or making forecasting feel like a high-stakes activity. For teams still building FinOps muscles, just noticing patterns over time is valuable:

“Every time we launch something, storage jumps.”

“AI experiments always create short-term spikes.”

“Some workloads creep up quietly unless someone checks.”

The goal isn’t perfection, it’s learning a little more each month about how the cloud behaves inside your organization.

5. What “forecastable enough” really means

A lot of cloud forecasting anxiety comes from the expectation that it should behave like a fixed cost. But the more you study FinOps, the more obvious it becomes that cloud spend isn’t supposed to be perfectly stable.

Instead, “forecastable enough” usually means something much simpler:

You generally know where spend is coming from.

You understand which services or projects tend to move the most.

You have a sense of what changes when teams ship new things.

You’re able to adjust your expectations as the business grows.

This version of forecasting is less about hard precision and more about building confidence: We don’t know the exact number, but we understand the shape of it.

That mindset alone makes forecasting feel much more achievable for finance, business, and engineering teams, especially for anyone still early on their FinOps journey.

Simplify Training with AI-Generated Video Guides

Simplify Training with AI-Generated Video Guides

Are you tired of repeating the same instructions to your team? Guidde revolutionizes how you document and share processes with AI-powered how-to videos.

Here’s how:

1️⃣ Instant Creation: Turn complex tasks into stunning step-by-step video guides in seconds.

2️⃣ Fully Automated: Capture workflows with a browser extension that generates visuals, voiceovers, and call-to-actions.

3️⃣ Seamless Sharing: Share or embed guides anywhere effortlessly.

The best part? The browser extension is 100% free.

RESOURCES

The Burn-Down Bulletin: More Things to Know

How to Establish and Drive a Forecasting Culture

AWS shows how to embed forecasting into everyday engineering and finance workflows, including using pricing calculators and cost tools to estimate workloads before they ship.Introducing 18-Month Forecasting and Explainable AI Insights in AWS Cost Explorer

This announcement walks through new AI-powered forecasting features in Cost Explorer that extend projections out to 18 months and explain the drivers behind those forecasts, which is perfect for longer-range FP&A cycles.FinOps for Finance Teams

Ternary’s finance-focused overview breaks down how finance, engineering, and FinOps teams can collaborate on budgets, forecasts, and commitment management using shared views of cloud data.Avoid Cloud Overruns: The FinOps + AI Blueprint

Virtasant explains how pairing AI forecasting with FinOps practices can cut cloud costs by 20–30 %, with concrete examples of how better visibility and predictive models reduce overruns.Mastering FinOps Reporting: Strategies to Optimize Cloud Costs and Drive Business Value

Pellera outlines a crawl–walk–run approach to FinOps reporting, including when to introduce budget tracking and variance analysis so that forecasts become more accurate over time instead of just more complicated.

That’s all for this week. See you next Tuesday!